Banks Are Gearing Up for Another Strong Year in CRE Lending

Despite a dip in mortgage originations in 2018, banks continue to have healthy appetite for CRE lending.

Despite a dip in mortgage originations in 2018, banks continue to have healthy appetite for CRE lending.

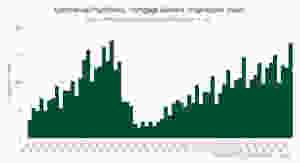

The Mortgage Bankers Association (MBA) recently reported another stellar year for commercial/multifamily mortgage originations in 2018. Although the MBA will release final data next month, results from its fourth quarter mortgage originations survey point to volume that could be 3 percent higher than the record $530 million reached in 2017.

In the midst of that continued robust lending, it is notable that bank lending took a step back with an estimated decline in mortgage origination volume of 10 percent. Yet industry experts have been quick to wave off any concerns that banks are tapping the brakes on lending.

“There are some areas that are more selective than others, but we don’t see a widespread pullback,” says Jeff Erxleben, executive vice president, regional managing director, for NorthMarq Capital in Dallas. The decline is likely due to a combination of factors, including a strong comparison year in 2017, more caution on construction lending and a highly competitive lending environment, he notes. However, banks continue to have a healthy appetite for commercial/multifamily loans and will remain an active player in the coming year, Erxleben adds.

Banks are facing more competition. Growth of non-bank lenders has added a whole new dimension to the competitive landscape, particularly in bridge and construction financing, notes Kathleen Farrell, executive vice president, line of business executive, commercial real estate, at SunTrust Banks. There are multiple bids on any opportunity or new project that needs construction financing. According to the MBA, GSEs and life companies increased loan originations by 16 percent and 10 percent respectively in 2018. Debt funds also saw a big jump of 29 percent from an estimated $52 billion in 2017 to $67 billion in 2018.

Lending accelerated in the fourth quarter

Yet banks were riding good momentum coming into 2019, with fourth quarter mortgage originations up 5 percent year-over-year, according to the MBA. Although that increase is lower than the broader market, which saw an estimated 14 percent jump in mortgage originations during the last three months of 2018, data doesn’t indicate a broader pullback or shift in strategy from the banks.

Banks grew their lending portfolios aggressively in 2015 and 2016. Activity slowed a bit in 2017 and 2018, but still maintained a pretty good clip in portfolio growth. So, part of that decline in volume is due to that comparison to previous stronger periods, notes Jamie Woodwell, MBA's vice president for commercial real estate research. “We’re continuing to see banks increase their holdings for commercial and multifamily mortgages,” he says. “So, if you look at it that way, there is still a good appetite out there from banks for those assets.”

The core property types that are most in demand continue to be multifamily and industrial, followed by office, hotels and then retail. However, banks are exhibiting caution even for favored property types in markets that have seen high levels of construction. Lenders are drilling down to look at specific submarkets and micro-markets to determine if there are concerns about oversupply, says Erxleben. Community and regional banks remain very active in commercial real estate lending; in some cases, more active than some of the national banks. In addition, community and regional banks are stepping out and doing larger and larger deals in terms of loan amounts, adds Erxleben.

Trends to watch in 2019

According to the MBA’s 2019 Commercial Real Estate Finance Outlook Survey, 74 percent of bankers anticipate lending activity that will be the same, if not higher, than in 2018,

while 26 percent expect a decrease. One important backdrop for the current bank lending climate is that bank commercial and multifamily loans continue to perform extremely well. The delinquency rate for those bank loans that are 90+ days past due is near record a low of 0.48 percent as of the third quarter. “So, I think a lot of banks have seen these portfolios perform very well for them,” says Woodwell.

One of the notable trends to watch in the banking sector is that some banks are doing more long-term, fixed rate loans with seven or 10-year terms for clients on a select basis. For example, SunTrust Banks started developing a permanent loan product about two years ago. “With the concern about rising interest rates, permanent financing was very attractive to our clients,” says Farrell. “So, we saw an opportunity to put together a five, seven or 10-year fixed-rate option for our clients.”

SunTrust’s longer term fixed-rate loan product started to gain momentum in 2018, as interest rates began to rise. SunTrust has also seen acceleration in its multifamily lending business following its December 2016 acquisition of Pillar Financial, which created an agency lending platform for the bank. SunTrust has since been expanding its full-service multifamily lending for market-rate, affordable and seniors housing assets through Fannie Mae, Freddie Mac and HUD.

Looking ahead to 2019, banks could face more headwinds in construction financing due to the late stage of the cycle and rising costs. “I think banks have been pretty disciplined in maintaining their underwriting standards when they evaluate construction loans,” says Ferrell. Developers have also been disciplined, and some are starting to put their pencils down on projects due to the high cost of land, rising construction costs and tariff implications. That is something that could occur more frequently later in 2019, which could result in a slight decline in construction volumes, she adds.

On the positive side, there is still a lot of equity targeting commercial real estate and what appears to be a steady transaction pipeline that will require financing. The interest rate horizon also looks like it will hold fairly steady in the near term. “Our expectation across all commercial real estate property types is for another strong year in 2019,” says Farrell. “Pipeline activity is very strong, and we think there are a lot of projects in various stages of development that are going to come out of the ground and need financing in 2019.”

DISCLAIMER: This blog/article has been curated from an alternate source and is designed for informational purposes to highlight the commercial real estate market. It solely represents the opinion of the specific blogger/author and does not necessarily represent the opinion of Pacific Coast Commercial.

All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner of will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information.

Keywords: San Diego Commercial Real Estate For Sale, Commercial Property In San Diego, Commercial Real Estate In San Diego, San Diego Investment Real Estate, Commercial Property Management In San Diego, San Diego Commercial Property Management, Commercial Property Management San Diego, Managed Commercial Property San Diego, Commercial Property For Sale San Diego, San Diego Commercial Real Estate Leasing, Top Real Estate Agents in San Diego, Commercial Property in San Diego, Property Management Company San Diego, Real Estate Agent in San Diego, San Diego Commercial Real Estate

Comments

Post a Comment